Accelerating the cloud future: Industry priorities and best practice

26 May, 2021

Key facts

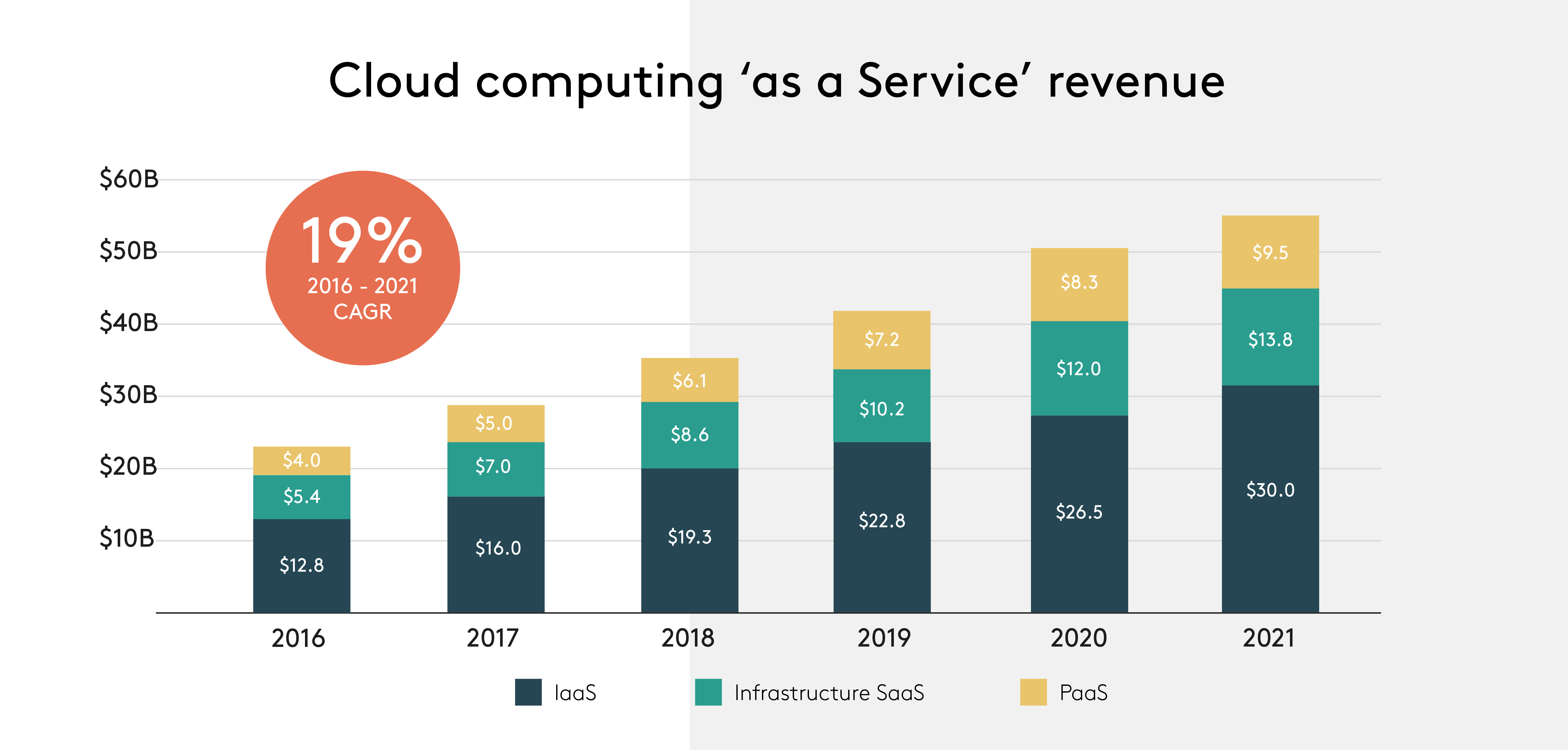

New findings from the Synergy Research Group revealed that cloud spending rose 37% to $29B during the first quarter of 2020 and is growing at a faster rate than analysts expected.

Cloud is inevitable and the COVID-19 crisis has proven why. As the pandemic started to take hold, our everyday lives became heavily exposed to the cloud with a rapid pivot to work from home and remote learning that provided us with connectivity, access to critical data, and real time collaboration.

Industry experts share that businesses no longer want to be tied to a single cloud platform. So, channel partners need to be able to offer their customers the freedom to choose, and access a multi-cloud approach to integrate with multiple collaboration tools that suit different areas of their business.

Organisations that made a high-level shift of priorities to a cloud model can benefit from an improved utilisation of resources:

- Transformation of telephony services

- Change in how we pay for products and services

- Remove burden of software developers

- Transformed cyber security

- Introduction of multi-cloud platform

- Made IT infrastructure, cheaper, faster, easier

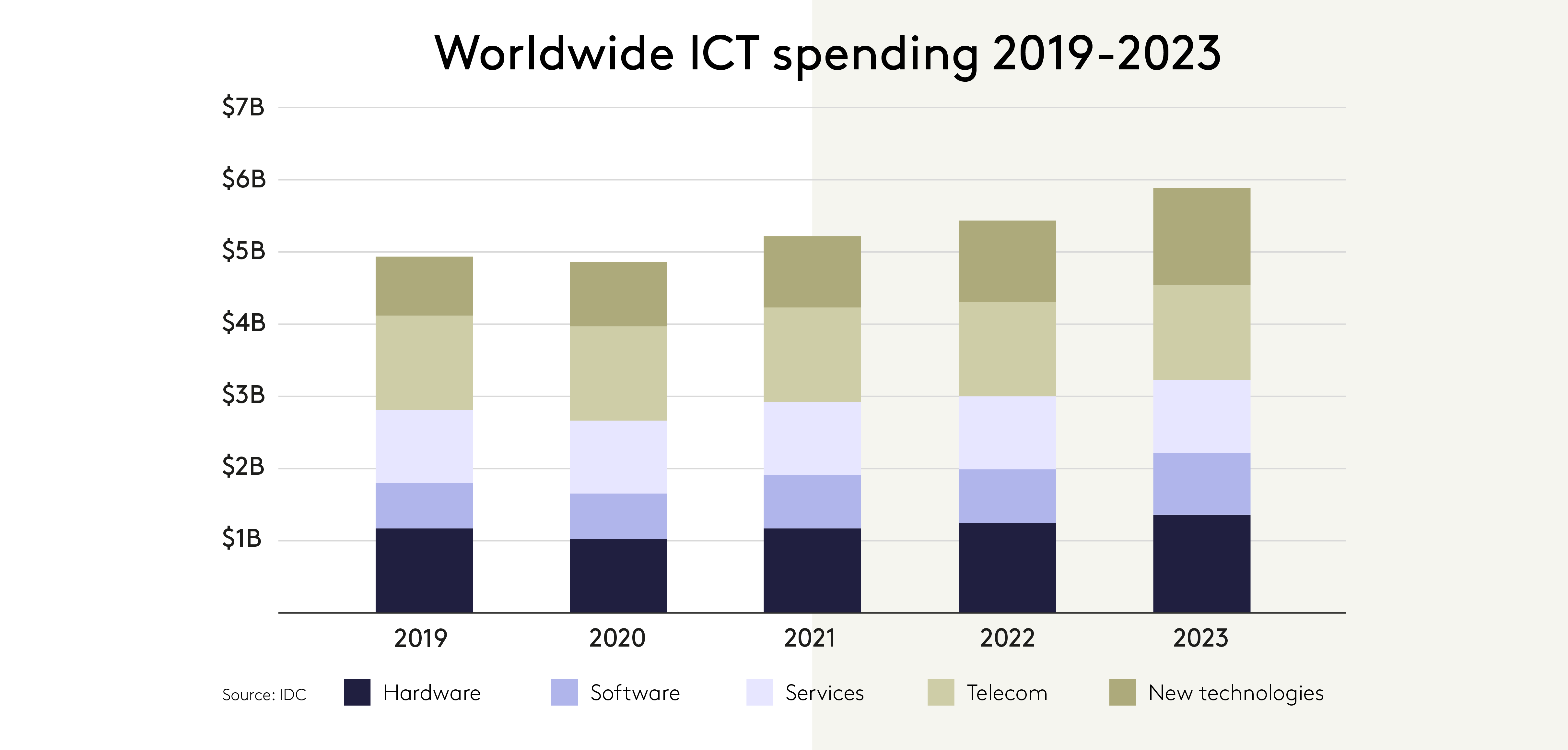

Although there was a softer approach to tech spend in 2020, cloud revenue continues to show momentum through 2023.

Space between the graphs.

Space between the graphs.

Space between the graphs.

Space between the graphs.

Top 5 cloud channel priorities

Improved IT infrastructure management, secure data storage, increased agility, accessing assets on the go through a centralised hub, and reducing costs and scaling are just a few reasons for the rise in cloud computing over the last ten years. We asked our cloud vendor partners to share their insights on five cloud trends that are fuelling the innovation engine of cloud strategies in 2021-22.

-

Trend 1: Expert cloud migration

The hyper-scale data centre market in Australia is set to increase at a rate of 4% from 2021 to 2025 as businesses move their data onto the cloud, out of internal facilities and into hyper-scale data centres operated by external companies to Infrastructure Australia.

-

Trend 2: Security

The biggest challenges that ITDMs face today when it comes to the ability to take full advantage of their public cloud resources are controlling cloud costs while boosting data privacy and security. As reported through a survey conducted by Infoblox, 56% of Australian companies have adopted multi-factor authentication technology as a result of COVID-19, compared to UK 48%, US 48%, China 43% and Japan 35%. Sectors expected to see the greatest shift in cybersecurity spending in the next 12 months are large enterprises for healthcare systems and services, banking and financial systems, technology, media, and telecommunications and public and social sectors, Infrastructure Australia detail.

-

Trend 3: Remote capabilities

Property Council of Australia highlights that increased commercial vacancies rates in Australian CBDs indicate that businesses are deciding to embrace remote work on a preeminent basis or downsize their space requirements permanently or downsize their space requirements for a hybrid workplace. The adaptable and interchangeable nature of a hybrid workforce goes far beyond remote work, urging the need for technology that can fully support everchanging shifts.

-

Trend 4: Bundled solutions

As businesses across verticals ramped up their market strategies and scrambled to provide the right solutions to enable their customers, filtering through the technology available was a difficult task for some. Vendors have put greater importance on enhancing their partner community.

-

Trend 5: Productivity features

With features like file sharing and audio and video capabilities utilised business-wide, the demand for secure real-time collaboration, communication and workflow management has birthed productivity enabling tools and technologies that the channel is continuing to heavily invest in. You can combine services from Microsoft Office 365 or Google Workspace with ISV and hardware solutions to build full proof value propositions that equip your customers with an end-to-end offering.

Leave A Comment